Annual Report 2022 in brief

Our 2022

Here you will find a selection of the most important events of 2022 at the Federal Pension Fund PUBLICA and our Annual Report 2022 in PDF format.

The year 2022 is one that many of us will remember for a long time. An event long considered inconceivable – the outbreak of war in Europe – became a reality, while the climate grew warmer and warmer. These developments pushed the coronavirus pandemic to the back of the public consciousness, though its after-effects continue to rumble on.

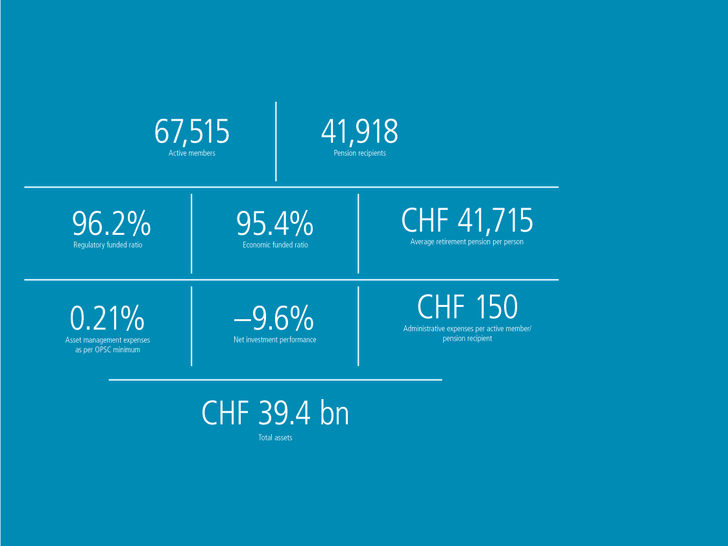

Those developments also left their mark on the financial markets. PUBLICA’s net investment performance in 2022 stood at –9.6%, compared with +4.4% in the prior year. The closed pension plans, which have a 10% equity allocation, posted a performance of –8.1% (prior year: +2.1%), while the open pension plans, with an equity allocation of at least 25%, recorded a figure of –9.7% (prior year: +4.6%).

The biggest negative contributors were bonds and equities, while real estate and precious metals recorded a positive result.

Asset Management deviated tactically from the strategic asset allocation in 2022, and made selection decisions. As a consequence, the consolidated net investment performance of –9.6% was 0.5 percentage points above that of the benchmark. The latter is calculated on the basis of the strategic asset allocation.

Owing to the negative performance, 14 pension plans are underfunded as at the end of 2022. The deterioration in their financial situation is partly attributable to rising interest rates, although these also lead to a higher expected return.

While 2022 was a difficult year on the financial markets, there were some positive developments:

- The Board of Directors adopted a new corporate strategy and a new strategic asset allocation, both of which PUBLICA has already begun implementing.

- In September, PUBLICA signed up to the Exemplary Energy and Climate initiative, in a commitment which supports the measures adopted by the Federal Council to achieve the climate goals. PUBLICA conducts its investments in an exemplary manner and reports regularly on the progress made in decarbonising its portfolio.

- Since 2021, the approximately 68,000 active members have been able to access their current pension data and pension certificates via the digital portal myPublica. The next step was completed in 2022, when the portal was expanded to include the approximately 42,000 pension recipients. They can now update their address, payment

account and marital status themselves. Those who live abroad have to submit a life certificate every year, which they can do quickly and simply via myPublica - A large part of PUBLICA’s premises was refurbished to create multi-space offices that facilitate communication and encourage teamwork. This saves space or allows it to be opened up for other uses, and gives staff modern and attractive places to work.

Sincerely,

Jorge Serra Doris Bianchi

Chair of the Board of Directors, PUBLICA Director, PUBLICA

2022 was an eventful year for the world as a whole, the financial markets and PUBLICA. The overall performance was negative, with 14 of 18 pension plans underfunded. Interest rates are rising, and we therefore expect significantly higher returns once again over the long term. We have adopted a new corporate strategy and a new strategic asset allocation, both of which we have already begun implementing.

Lorem ipsum dolor

.jpg)